We are Abu-Dhabi/Dubai based Independent Private Equity & General Trading firm focused on high potential growth MENA private equities and trade commodities. with live network of Top 50 GCC Investment firms. DARAHIM plays a role in the Global supply and demand of major commodities worldwide in Wholesale trading. DARAHIM offers a range of alternative and traditional investment strategies to investors around the world including clean energy green field projects. DARAHIM has continued to evolve from a dedicated private equity investment funding firm to a diversified Overseas Trading in addition to transacting in Real Estate, Venture Capital, Venture Debt Facilitation.

DARAHIM Investments

Investment Opportunities

Private Equity Aquisition Food & Beverage

USD 10,000,000

200 MW Solar Power Park Project

USD 150,000,000

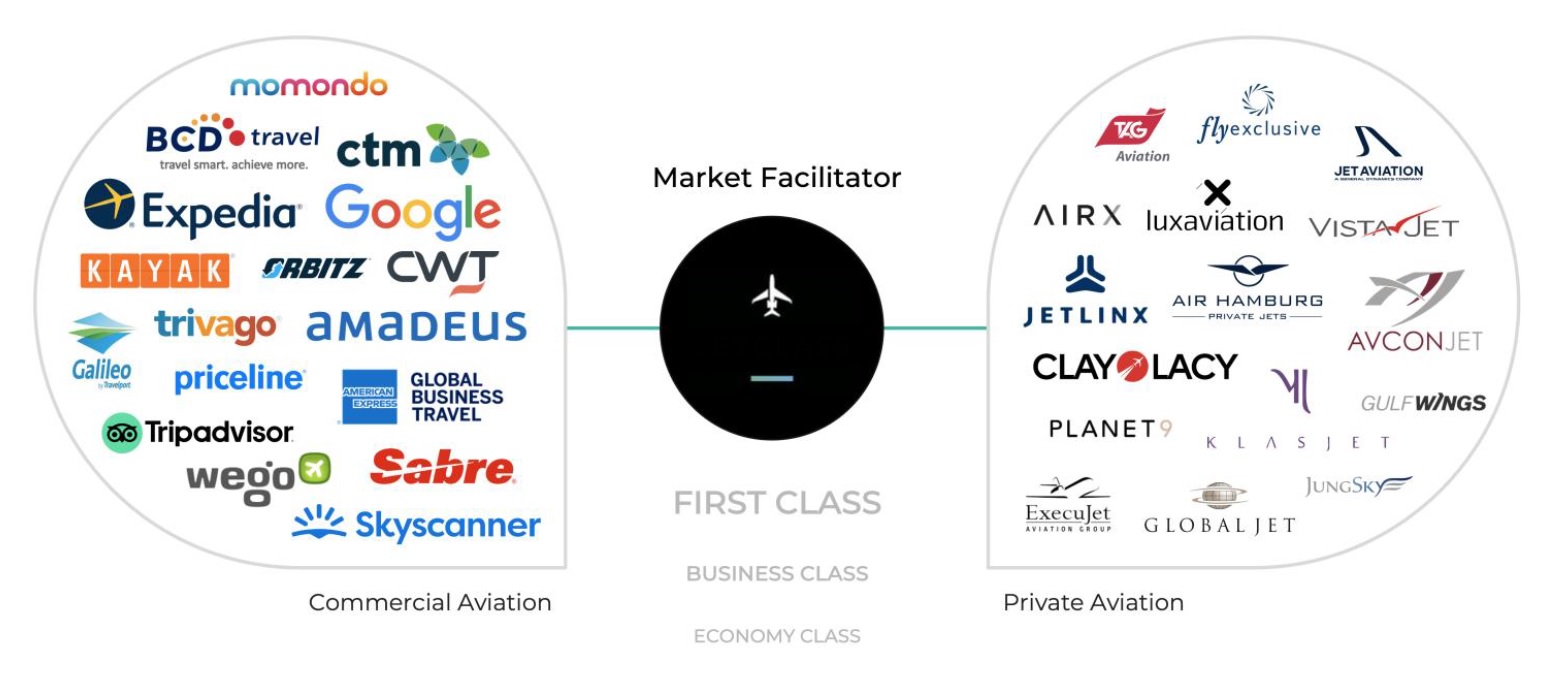

Pre A Series VC Private Jets *Uber* Unicorn- Private Pre-Series A

USD 10,000,000

Dairy, Juices, Processed Cheese, Sauces, Jams, Canned Food Manufacturer - EGYPT

USD 35,000,000

Dubai Marina Tower Hotel Apartment

AED 350,000,000