Private Equity Aquisition Food & Beverage

USD 10,000,000

Company is a profitable company established in 2017 and is a globally registered trademark specialized in monofloral honey company worldwide. Farms and technologies currently have 120 farms deployed in 44 countries around the world. The master plan in the pipeline is to cover 10,000 locations world-wide. It produces over 280 types of monofloral honey and plans to produce 800 types in the next few years. Pitch deck available. ***Round Details*** Total Sales since inception amounts to $10.5M Current yearly Growth rate is 45% Within this year of 2023, Compnay is raising a total of ~$10M on a $64M pre-money valuation to expedite execution to the next level Within 3 years Company is expected to grow by 3X~5X

200 MW Solar Power Park Project

USD 150,000,000

200 MW Solar Park Project Engineering by a firm in Germany with a local office in Dubai Project IRR (ebitda) 15% Project Cost USD 150 M Financial Model developed, where first year net revenue is expected to be above USD 20 Million (based on USD 6 Cents per KW Tariff). These figures could be improved further if better tariff rates were negotiated with state energy utilities. We have already developed the technical concept and financial model for the solar park and are ready to discuss all aspects of the partnership, land, design, tariff, and future outcomes Why partner with us? because will be working together minimizing engineering and construction cost markups. Since solar parks are relatively new to this region, the average cost per 1MW for similar projects has seen up USD 4 Million. On the contrary we who are specialized in this field are able to delivery for less than USD 1 Million per MW.

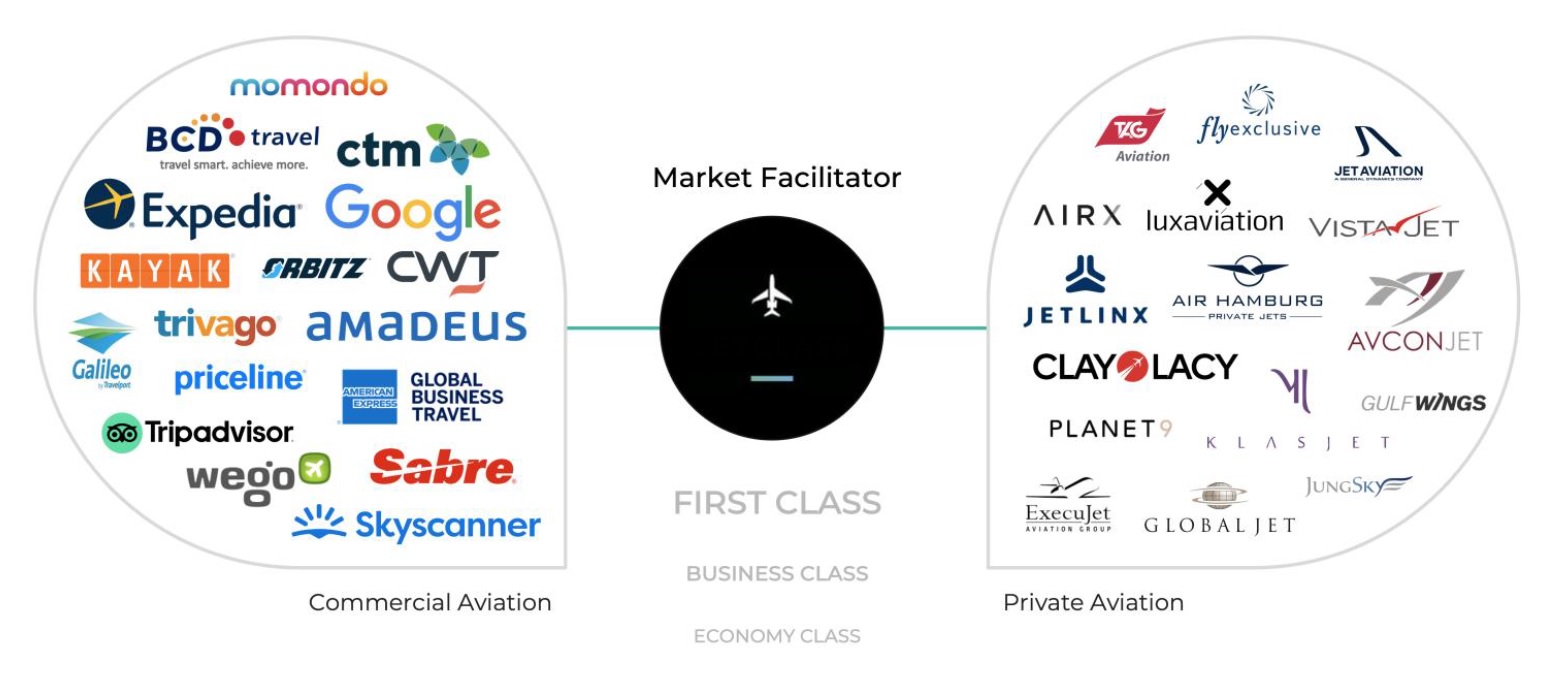

Pre A Series VC Private Jets *Uber* Unicorn- Private Pre-Series A

USD 10,000,000

$50 Million in Sales Since inception and are on track to cross the $1B mark in the next 4 years. The Compnay is revolutionizing the global private aviation industry by solving its biggest challenges and tapping into the growing demand for private jets. Our innovative platform is the first Global Distribution System (GDS) for private aviation, offering easy booking and mass distribution through unprecedented open APIs to metasearch platforms like Expedia, Kayak, Skyscanner, etc. Thanks to almost 10 years of practical experience and existing data, Company is the first company to have solutions that work and have been executed successfully in practice already.

Dairy, Juices, Processed Cheese, Sauces, Jams, Canned Food Manufacturer - EGYPT

USD 35,000,000

Direct Private Equity Acquisition for 49% equity. Food Industries Company in Burj Al Arab Alexandria Egypt based Food & Beverage Company established in 2010 to produce, manufacture, and pack food such as dairy, juices, processed cheese, sauces, jams, canned and food oils, distributing them locally and exporting them internationally to all countries of the world

Dubai Marina Tower Hotel Apartment

AED 350,000,000

TOWER for Sale in Dubai Marina Rent ROI 6%

SEED VC Theraputics CAR-T CELL Cancer Treatment

USD 7,000,000

CANCER TREATMENT TECHNOLOGIES BASED ON CHIMERIC ANTIGEN RECEPTOR (CAR)-T CELL IMMUNOTHERAPY presented by Adoptive Biopharma LTD. our client-based in the US with partnership locations to establish in the UAE. Adoptive is developing new immunotherapy technologies to fight metastases. More than 90% of cancer deaths are caused by the metastases of solid tumours. The market opportunity is massive >$100B for cancer metastases treatments. With investment to accelerate its pipeline this company has the potential to generate a single anti-metastases CAR-T therapy that has potential annual global sales >$5B.

Resort Hotel Residential Prime Mix Use Plot On The Water In Al Reem Island

AED 127,000,000

USD 35,000,000

Resort Hotel Residential Prime Mix Use Plot on the water in Al Reem Island

Plot In Business Bay Burj Khalifa District

AED 140,000,000

Plot in Business Bay Burj Khalifa District Plot Size 40K sqft Permit G + Unlimited GFA Unlimited Use: Mix-use (Hotel / Hotel Apartment / Residential)

Dubai 4 Star Dry Deluxe Hotel Apartments - 8% ROI Long Term Lease

AED 220,000,000

253 Rooms( mix of Studio and 1 bedroom) Building Details : (G+3P+Ameneties Floor + 24 Floors) Long term Lease for 8% ROI.

Residential Tower In Al Reem Island

AED 170,000,000

Residential Building for Sale 7% ROI In Al Reem Island Abu-Dhabi UAE Free hold ownership open to all nationalities 2 years old. Fully rented. Income 7% Price AED 170 Million

Al Reem Island Abu-Dhabi Magnificent Canal View Hotel Plot

AED 28,000,000

Prime Canal View Hotel Plot in Shams Al Reem Island. This ready for construction project is situated close to the Sky Tower and Shams Marina community, has a footprint of 200K Sqft GFA, with a Plot area of 20K sqft. The Plot comprises of one Hotel tower 25 stories on podium. 150 Keys.

Al Reem Island Abu-Dhabi Magnificent Waterfront Residential Plot

AED 105,000,000

USD 28,000,000

Prime Waterfront Residential Plot in Al Reem Island. This ready for construction project is situated at the gate and waterfront of Al Reem Island, has a huge residential footprint of 660K Sqft GFA, with a Plot area of 70K sqft. The Plot comprises of two residential towers 25 stories each on one podium. Plot is strategically located at the entry to Reem Island approximately 300 meters from the Abu Dhabi mainland and within walking distance to the largest mall in the region Al Reem Mall. Best option for smart tenants who prefer less traffic and best views of the sea. Which makes this plot a super prime location.

Danet Abu Dhabi Magnificent Huge Residential Plot

AED 50,000,000

Huge Residential Plot in Danet Abu Dhabi. This ready for construction project is situated at the heart of Abu Dhabi Island in the modern District of Danet Abu Dhabi, has a huge residential footprint of 365,000K Sqft BUA, with a Plot area of 40K sqft. The Plot comprises of one residential tower 21 stories on podiums. Danet Abu Dhabi is one of the fastest-growing neighborhoods in the emirate. The locality has well-known schools, restaurants, and supermarkets. Many popular hospitals and clinics are also close by. Those looking for a luxurious lifestyle will find that living in Danet Abu Dhabi ticks all the boxes. UAE Nationals ownership only.

Rawdat Residential Plot

AED 11,500,000

Plot Area 11K sqft GFA 38K Sqft G+4

Royal Marina Residential Villa

AED 23,000,000

Greek Side

Saray Abu Dhabi Corniche Commercial Offices Plot

AED 75,000,000

Saray Abu Dhabi Commercial Office Plot GFA 300K